Debt Settlement Lawyer Near Me: When To Hire One?

If you find yourself grappling with overwhelming debts and enduring incessant communication from creditors, the assistance of a nearby debt settlement lawyer can be your lifeline. In this article, we delve into the indispensable role played by debt collection lawyers and pinpoint the opportune moments to engage their services. When financial obligations become burdensome, and […]

Debt Collection Lawyers Near Me: 10 Reasons To Hire One

The demand for debt collection lawyers has become increasingly evident in the current financial climate. With individuals and businesses wrestling with mounting debts, the quest for viable solutions has reached a critical juncture. If you find yourself ensnared in financial difficulties, searching for “debt collection lawyers near me” could be your gateway to the expertise […]

Tax Debt Discharged in Nevada

Get Rid of Tax Debt in a Nevada Bankruptcy Bankruptcy may be the best option to eliminate or manage a debt that is more than a few years old. However, the treatment of tax debt in bankruptcy is exceedingly intricate, which is why so many individuals are perplexed. Many people feel that Uncle Sam will never […]

Should I Tell Creditors That I Plan to File for Bankruptcy in Las Vegas?

Having an overwhelming debt, an account going into collections, or having a lawsuit filed against you can be stressful. Our Las Vegas bankruptcy and consumer protection attorneys at Freedom Law Firm are here to help. Over the past twenty years, we have helped thousands of people get out of debt. When deciding whether to tell […]

DETR BofA Card Issues: Freedom Law Firm Is Assisting People Who Couldn’t Access Their Unemployment Funds.

Our Nevada Consumer Attorneys At Freedom Law have been retained by hundreds of Nevada residents who couldn’t use their unemployment benefits due to fraudulent activity on their BofA accounts. About Unemployment Account Fraud and BofA Card Issues: According to the statement issued by the Nevada Department of Unemployment, the Bank of America prepaid debit MasterCard […]

Financial Stress & Mental Health: Is Debt Making You Sick?

Debt is big this year. According to the Federal Reserve, both U.S. consumer debt and consumer credit card debt hit an all-time high during the fourth quarter of 2019, the most recent reporting period. Credit reporting agency Experian says Nevada residents are carrying a significant chunk of that debt: more than $138 billion worth. We […]

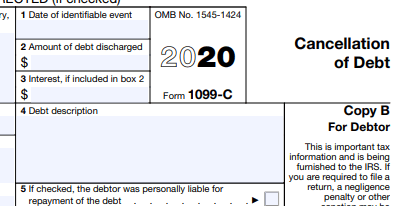

When is Canceled Debt Taxable?

While a few debt resolution strategies are focused on restructuring debt, many involve cutting down the amount paid. Some examples include: Negotiating directly with creditors to settle debts for less than the outstanding balance Debt management plans in which non-profit credit counseling agencies negotiate on behalf of a consumer to cut down debt Debt settlement […]

Reaffirming a Car Loan in a Las Vegas Bankruptcy

When you file for Chapter 7 bankruptcy, the key benefit is that many unsecured debts are discharged. That means you are no longer legally responsible for paying them. However, you cannot simply discharge a secured debt and keep the property that serves as security for that loan. This issue arises most often in connection with […]